April 2022 Newsletter

Contents:

- The Budget has a Small Business Focus

- Common Misconceptions with Deceased Estate Taxes

- Victorian Wage Theft Laws

- How Stress and Burnout are Importantly Different

- 8 Things to Look for When Buying an Investment Unit

- Pensioner and Jobseeker Payments to Increase

- Announcements

The Budget has a Small Business Focus

Pre-election Budget focused on cost of living relief and new small business tax incentives.Common Misconceptions with Deceased Estate Taxes

Colonial First State has warned advisers on some of the common misconceptions around the taxation and Centrelink treatment of deceased estates and when taxes need to be paid by beneficiaries.

Speaking in a recent podcast, Colonial First State head of technical services Craig Day said that where a client passes away, it’s a common misconception that as long as the estate is kept open, then no beneficiaries need to pay tax and that the assets don’t count for Centrelink purposes.

Victorian Wage Theft Laws

On 1 July 2021 the Wage Theft Act 2020 (Vic) (the Act) came into effect bringing with it a list of offences in relation to employee entitlements and record keeping, breaches of which may lead to significant fines and even prison sentences.

How does the Act define an offence?

Pursuant to Part 2 of the Act, an employer, whether it be a company or individual, commits a criminal offence if it:

How Stress and Burnout are Importantly Different

Even before the pandemic, burnout was said to be reaching epic proportions; a third of workers reported that they felt burned out. Since the pandemic, it’s skyrocketed.

Stress helps us to respond to the challenges we face, and most people experience manageable, if higher, levels during crises. When the challenges don’t let up, though, stress goes beyond manageable levels. Given that the pandemic won’t be over any time soon, we need to become better at noticing stress, reducing overwork and increasing wellbeing to prevent chronic stress and burnout.

8 Things to Look for When Buying an Investment Unit

Are you planning to buy an apartment unit as an investment property? Here are things you should look for before purchasing one.

Are you planning to buy an apartment unit as an investment property?

Long considered by many as nothing more than an affordable alternative to houses, investing in units is fast becoming a way for property investors to access the high capital growth that is traditionally associated with its counterpart sector.

Pensioner and Jobseeker Payments to Increase

The government said the boost to social security payments is aimed to help individuals keep up with cost of living.

The federal government has announced that Australian pensioners will begin receiving an additional $20 per fortnight from next week in line with rising inflation.

Nearly five million individuals will benefit from the higher payments, according to the government, including recipients of the age pension, disability support pension and carer payment who will receive an extra 2.1 per cent as a result of indexation.

Announcements:

This month we wish Richard, Laurie, Katrina & Cris a very happy birthday from all the team at Knights Accounting and Watts Price Accountants!|

|

|

|

|

|

|

Important ATO Dates

| Lodgement Program | Date |

| March monthly activity statements | 21/04/2022 |

| Quarter 3 (January–March) PAYG instalment activity statement | 21/04/2022 |

| Quarter 3 (January–March) activity statements | 28/04/2022 |

| Quarter 3 (January–March) PAYG instalment notices (forms R and T) | 28/04/2022 |

| Quarter 3 (January–March) GST instalment notices (forms S and T) | 28/04/2022 |

| Quarter 3, (January–March) super guarantee contributions | 28/04/2022 |

Other News

We say farewell to Cris

|

|

|

|

|

It is with mixed emotions that we farewell Cristine Semmler, or “Cris” as we all know her!

Cris started at Watts Price back on 16/08/2001 and will finish up on Friday the 22nd of April, some 20 and half years later.

Cris has been our front desk superstar and has a fantastic relationship with both clients and staff and we know that many of you will miss her as much as we will.

We wish Cris all the best in her future endeavours – whatever they will be!

Important Domain Change

Anyone using a “.com.au” or “.gov.au” domain needs to be aware that last week a shorter domain became available, the “.au” domain.

Example: In addition to our already registered “wattsprice.com.au”, “wattsprice.au” is now available!

Why this is important, is that if you don’t purchase your current business’s “.au” domain before 20 September 2022, then it will become available on the open market and any member of the public could buy it.

One major concern about not purchasing it is that cyber criminals or competitors may purchase it and use your brand recognition to drive traffic to their websites.

All small business owners should definitely give this matter serious consideration!

ATO: Penalties for overdue TPAR

Banklink Changes

Please note that after 20+ years MYOB is effectively retiring Banklink by removing all support for the product after 01/07/2022. After careful consideration we have sourced a newer product to meet your, and our needs. We wanted to keep the process similar to minimise the disruption to your business with these changes.

What Changes?

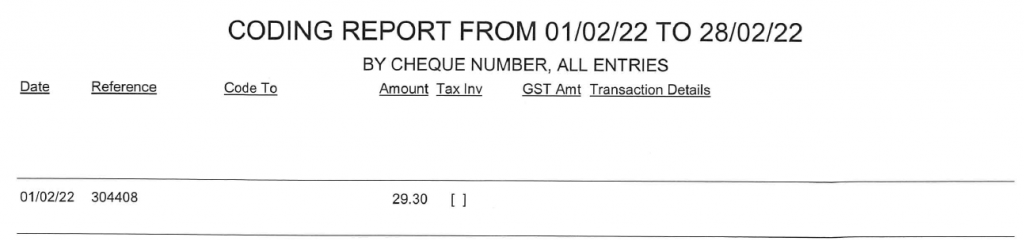

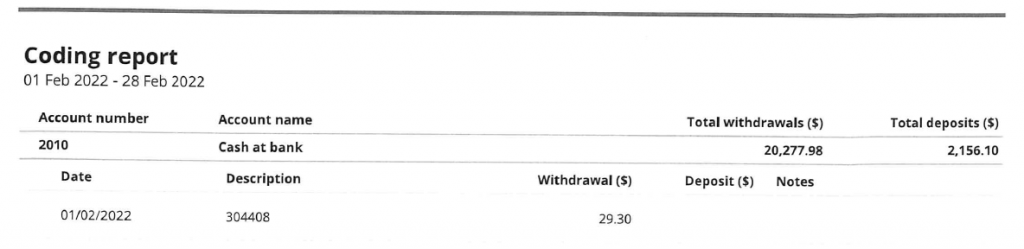

For clients that receive their coding reports from us either via email or post there will only be a subtle change or two. Firstly, the format of the Coding Report will change from the one shown in diagram 1 to that shown in diagram 2 below.

|

1 |

|

|

2 |

|

Postal Delivery – For those that receive their Coding Report in the mail, we will continue to post the coding reports to you (i.e. no change).

Email Delivery – For those that receive their Coding Report via email, the coding report email will be sent directly to you from MYOB going forward rather than Joanne or Hayley from Watts Price or Margaret at Knights Accounting. These will be sent out about the 5th of each month going forward. Please ensure you check your Junk folder if it has not arrived within a few days of the 5th and let us know if we need to have it resent.

Note: You will still receive an email from us each quarter with the quarterly BAS checklist.

Banklink Books or Banklink Notes – for those clients that do their own coding via Banklink Books or Notes, we will be sending you an invite to the new software once it has been setup and contacting you to arrange training.

We estimate that we will be up and running on the new software by early April in time to process the March quarter.

If you have any queries please contact our office!

Company Folders

With the shift to electronic sending, filing and signing of documents, ASIC has confirmed that we no longer need to hold hardcopies of the Company Folders we hold on behalf of our clients. Therefore we are currently in the process of scanning all Company Folders and relevant documents to our secure in-house server and will maintain an electronic (softcopy) version going forward. Once scanned we will contact clients and let them know that we are returning the original folder and its current content to them for safe keeping. Rather than risk losing your folder in the post we will hold these folders at our office for collection next time you drop in. Please note that this does not change the ASIC compliance services we provide to you in anyway, we are simply maintaining your Company Folder electronically rather than in paper form going forward!Director Identification Numbers (DINs)

A reminder that all company Directors are required to obtain a Director ID. This is particularly important as failure to comply with these new Director ID requirements may result in both civil and criminal penalties. We recommend that company directors, including those that act as a corporate trustee of their SMSF or family trust, start the application process as soon as possible! How do I apply for a Director ID? Each individual director must apply for their own Director ID directly, to verify their identity via the ABRS website (abrs.gov.au), where you will click on the heading Apply for your Director ID. When do I need to apply for a Director ID? When you must apply for a Director ID depends on the date you became a director (as outlined below).| Date you were/are appointed | Date you must apply by |

| On or before 31 October 2021 | 30 November 2022 |

| Between 1 November 2021 and 4 April 2022 | Within 28 days of appointment |

| From 5 April 2022 | Before appointed director |

Single Touch Payroll Phase 2

- Your first STP Phase 2 report is required by 31/03/2022 (where not covered by a deferral) or 31/12/2022 (with deferral from your software provider).

- QuickBooks Online & Keypay deferral ends 28/02/2022.

- MYOB & Xero deferral ends 31/12/2022.

- Your software provider will be providing guidance on how to get STP 2 ready.

- Where Watts Price or Knights Accounting process your payroll we will ensure that you are STP Phase 2 compliant by the appropriate date. Our wages template will be re-issued to accommodate the new pay and leave categories required.