May 2022 Newsletter

Contents:

- How to Prepare for your Tax Return

- What are the new Changes to Super?

- ATO Releases Resources for STP Phase 2

- The A to Z of Director IDs

- How does the Income Tax Offset Work

- Fuel Tax Credit Change from 30/03/2022

- Announcements

How to Prepare for your Tax Return

While the end of the financial year is still a couple of months away, you can take action now to help maximise your tax return.H&R Block director of tax communications Mark Chapman told nestegg that individuals should take the time to gather the information they will need to help them prepare their tax returns.

What are the new Changes to Super?

The latest changes to super in Australia cover four key areas:

Removal of the $450 threshold for super contributions

Expansion of the First Home Super Saver Scheme

Abolishing the work test for retirees

Expansion of the Downsizer Scheme

ATO Releases Resources for STP Phase 2

The Tax Office has updated its resources to help employers understand the changes and prepare for STP phase 2 reporting.

The ATO offers employers detailed guidelines on STP phase 2 reporting requirements along with webinars about the changes featuring industry professionals providing practical examples and suggestions.

The A to Z of Director IDs

From April 5, director identification numbers start to become mandatory in a move to crack down on illegal business activity.

Designed to promote the integrity of the corporate system, director IDs aim to cut out false business identities, adverse cross directorships and phoenix companies.

How does the Income Tax Offset Work

Millions of taxpayers will receive hundreds of dollars more in their tax return this year.

More than ten million Aussie workers will receive an extra tax offset of $420 for the current financial year through an increase to the low and middle income tax offset (LMITO).

Under the LMITO, workers with a taxable income of between $48,001 and $90,000 have received a tax offset of $1,080 each financial year since 2018-19.

Fuel Tax Credit Change from 30/03/2022

The fuel tax credit calculator includes the latest rates and is simple, quick and easy to use. You can use it to work out the fuel tax credit amount to report on your business activity statement (BAS).

The following tables contain the fuel tax credit rates for businesses from 30 March 2022 to 30 June 2022.

Announcements:

This month we congratulate Hayley on achieving another work anniversary at Watts Price Accountants! |

||

Important ATO Dates

| Lodgement Program | Date |

| Fringe benefits tax (FBT) return – Final date for lodgment and payment if required | 21/05/2022 |

| April monthly activity statements | 28/05/2022 |

Other News

Tax Planning

SMSF Audit Changes

Please note that the Self Managed Superannuation Fund (SMSF) auditor that we have used for the last 20+ years, Peter Monaghan, is retiring as at 30 June 2022.Accountant / Bookkeeper

Watts Price Accountants is currently seeking an accountant or bookkeeper to join their team. For the successful candidate the position could be part or full time to suit their lifestyle.

A copy of the Position description can be viewed below.

If you have any queries please contact Richard Kemp on 5382 3001 or via email at richardk@wattsprice.com.au.

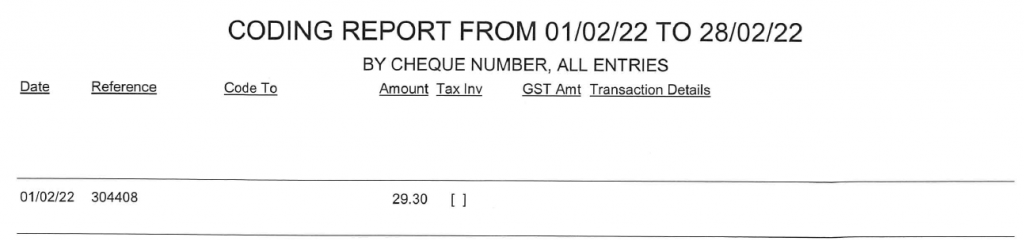

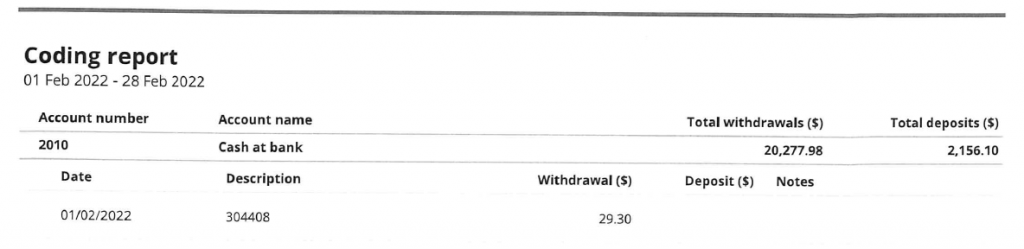

Banklink Changes

Please note that after 20+ years MYOB is effectively retiring Banklink by removing all support for the product after 01/07/2022. After careful consideration we have sourced a newer product to meet your, and our needs. We wanted to keep the process similar to minimise the disruption to your business with these changes.| 1 |  |

| 2 |  |

Company Folders

With the shift to electronic sending, filing and signing of documents, ASIC has confirmed that we no longer need to hold hardcopies of the Company Folders we hold on behalf of our clients. Therefore we are currently in the process of scanning all Company Folders and relevant documents to our secure in-house server and will maintain an electronic (softcopy) version going forward.Director Identification Numbers (DINs)

A reminder that all company Directors are required to obtain a Director ID. This is particularly important as failure to comply with these new Director ID requirements may result in both civil and criminal penalties. We recommend that company directors, including those that act as a corporate trustee of their SMSF or family trust, start the application process as soon as possible! How do I apply for a Director ID? Each individual director must apply for their own Director ID directly, to verify their identity via the ABRS website (abrs.gov.au), where you will click on the heading Apply for your Director ID. When do I need to apply for a Director ID? When you must apply for a Director ID depends on the date you became a director (as outlined below).| Date you were/are appointed | Date you must apply by |

| On or before 31 October 2021 | 30 November 2022 |

| Between 1 November 2021 and 4 April 2022 | Within 28 days of appointment |

| From 5 April 2022 | Before appointed director |

Single Touch Payroll Phase 2

- Your first STP Phase 2 report is required by 31/03/2022 (where not covered by a deferral) or 31/12/2022 (with deferral from your software provider).

- QuickBooks Online & Keypay deferral ends 28/02/2022.

- MYOB & Xero deferral ends 31/12/2022.

- Your software provider will be providing guidance on how to get STP 2 ready.

- Where Watts Price or Knights Accounting process your payroll we will ensure that you are STP Phase 2 compliant by the appropriate date. Our wages template will be re-issued to accommodate the new pay and leave categories required.

Ventilation Program

The Small Business Ventilation Program is now open. The Victorian Government is providing $60 million for public-facing small businesses to improve ventilation.

This support has been designed to help businesses implement new guidance on building ventilation to reduce the risk of spreading COVID‑19 and to keep customers COVIDSafe.

The Small Business Ventilation Guide is also available, which provides simple tips to help businesses improve ventilation.

Eligible businesses can now apply for funding to invest in equipment, undertake works or engage professional services to improve ventilation in areas of the workplace that are accessible to customers.

Under the program, 2 types of support are available:

Applications are open until 11:59pm Friday 24 June 2022, or until funds are exhausted.

This program is a part of a broader Business Stimulus Package. To learn about other support you could access, visit Business Stimulus Package.